Liechtenstein’s Modern Day Grave Robbers

In the early 1990s, Information Technology specialist Klaus Lins claimed to have discovered evidence that a Liechtenstein fiduciary was misappropriating the assets of wealthy clients when they died, instead of distributing them to beneficiaries. Lins turned whistleblower but the only person who went to prison was him, for data theft.

He also lost his home and his wife and he has since passed away. When one German beneficiary turned up at the fiduciary’s office in Liechtenstein, she was allegedly fobbed off with lies.

More recently, the family of Israeli tycoon Israel Perry has been waging a bitter legal war against a trust company in Liechtenstein in a so-far vain attempt to gain access to the deceased’s vast fortune.

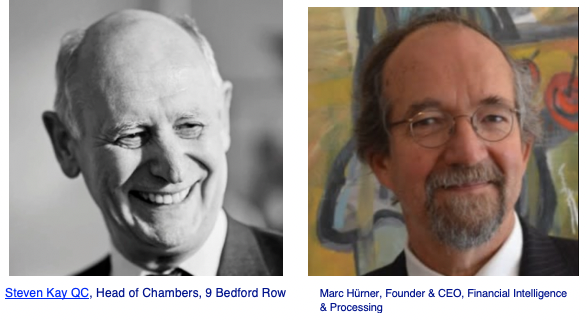

At the upcoming OffshoreAlert Conference in London, British international criminal lawyer Steven Kay QC and European fraud investigator Marc Hürner will present evidence of questionable practices by Liechtenstein-based offshore service providers and discuss remedies.

The 7th Annual OffshoreAlert Conference Europe will take place at the Grange St. Paul’s Hotel, in London, on November 12-13th, 2018

Are Trustees Misappropriating Assets When Clients Die & What Are The Remedies?

This session will look at allegations of impropriety against Liechtenstein-based fiduciaries, whether a culture of criminality exists in the jurisdiction, and potential legal remedies for beneficiaries who suspect they have been swindled.

Speakers

“Inside Liechtenstein: Are Trustees Misappropriating Assets When Clients Die & What Are The Remedies?” is one of 17 sessions taking place at the 7th Annual OffshoreAlert Conference Europe on 12-13 November in London.

What is a Foundation (Stiftung)?

The Foundation replaced a Trust in popularity in Liechtenstein and is based upon a statute incorporating it - that the original settlor should approve. The statute gives total control of all assets transferred by the settlor to the board of the Foundation (Stiftungsrat).

Once an object has been transferred to a Stiftung it becomes impossible to find out who the real owner is. This information is contained in the Statuten and Bei-Statuten and only available to the Stiftungsrat. Without oversight, the Stiftungsrat can do whatever he (she) pleases and is accountable to no one.

In Liechtenstein law this has been approved and discretionary beneficiaries have no rights.

A dangerous form of tax avoidance.

Ever since Philippa died there has been no way to determine what fate awaits her estate. Worse still, it could be in the process of being surreptitiously sold off or transferred elsewhere.

I do not know for sure if this is the case, but until I see otherwise it remains a distinct possibility.

This is not an isolated situation. Die Presse, 31 January 2018 and the Independent, Thursday 8 March 2018 partially explain the problem.